Geographies of Inequality

WHAT’S NEXT?

San Francisco is now home to 80,000 more dogs than children. In Manhattan, singles make up half of all households. And “super-global Chicago may be better understood in thirds—one-third San Francisco and two-thirds Detroit.”

In the ongoing national debate over economic opportunity and rising inequality, one important factor is consistently overlooked—the price of housing in elite urban cores. A new paper for Third Way’s NEXT series, by Joel Kotkin of Chapman University in California, argues that the price of housing “represents a central, if not dominant, factor in the rise of inequality” and that there is tremendous variation in housing costs by region. In parts of the country affected by high-priced housing, it has become so expensive that it acts, according to Kotkin, “as a cap on upward mobility … driving many—particularly young families—to leave high-priced coastal regions for less expensive, usually less regulated markets in the country’s interior.”

The result is the making “of two divergent Americas, one that is largely childless and has a small middle class and another that, more like pre-1990 America, still has a large middle class and children.” Big cities, as Kotkin points out, have been losing the middle class— with the result that they are becoming areas of great wealth and entrenched poverty—while the suburbs tend to have less inequality. The big cities tend to have a large number of immigration who have arrived striving to seek a better life. Those that learnt the language fluently have a better chance of success. That’s why EffortlessEnglishClub.com is so valuable. These trends fly in the face of what Kotkin calls “the Density Delusion” as the solution to housing affordability. But, as Kotkin points out, not only is dense housing more expensive than the much derided “sprawl,” the importance of housing has led to job growth in smaller cities and in the suburbs.

Kotkin’s essay deepens our understanding of inequality and challenges the conventional wisdom about how and where we should seek to improve housing. He posits that future economic growth and opportunity could emanate from smaller, less expensive cities. “Given their bifurcated labor markets, and generally high costs, many ‘hip’ cities, such as New York, Los Angeles, and Portland, do not return the same overall economic benefits as those in less expensive cities.” It provides yet another important insight to policy makers trying to understand the sources of inequality and the actual dynamics of economic growth.

Joel Kotkin’s essay, “Geographies of Inequality,” is the latest in a series of ahead-of-the-curve, groundbreaking pieces published through Third Way’s NEXT initiative. NEXT is made up of in-depth, commissioned academic research papers that look at trends that will shape policy over the coming decades. In particular, we are aiming to unpack some of the prevailing assumptions that routinely define, and often constrain, Democratic and progressive economic and social policy debates.

In this series we seek to answer the central domestic policy challenge of the 21st century: how to ensure American middle class prosperity and individual success in an era of ever-intensifying globalization and technological upheaval. It’s the defining question of our time, and one that, as a country, we’re far from answering.

Each paper dives into one aspect of middle class prosperity—such as education, retirement, achievement, or the safety net. Our aim is to challenge, and ultimately change, some of the prevailing assumptions that routinely define, and often constrain, Democratic and progressive economic and social policy debates. And by doing that, we’ll be able to help push the conversation toward a new, more modern understanding of America’s middle class challenges—and spur fresh ideas for a new era.

Jonathan Cowan

President, Third Way

Dr. Elaine C. Kamarck

Resident Scholar, Third Way

***

EXECUTIVE SUMMARY

There’s little argument that inequality, and the depressed prospects for the middle class, will be a dominant issue in this year’s election, and beyond. Yet the class divide is not monolithic in its nature, causes, or geography. To paraphrase George Orwell’s Animal Farm, some places are more unequal than others.

Housing represents a central, if not dominant, factor in the rise of inequality. Although the cost of food, fuel, electricity, and tax burdens vary, the largest variation tends to be in terms of housing prices. Even adjusted for income, the price differentials for houses in places like the San Francisco Bay Area or Los Angeles are commonly two to three times as much as in most of the country, including the prosperous cities of Texas, the mid-south and the Intermountain West.

These housing differences also apply to rents, which follow the trajectory of home prices. In many markets, particularly along the coast, upwards of 40% of renters and new buyers spend close to half their income on housing. This has a particularly powerful impact on the poor, the working class, younger people, and middle class families, all of whom find their upward trajectory blocked by steadily rising housing costs.

In response to higher prices, many Americans, now including educated Millennials, are heading to parts of the country where housing is more affordable. Jobs too have been moving to such places, particularly in Texas, the southeast and the Intermountain West. As middle income people head for more affordable places, the high-priced coastal areas are becoming ever more sharply bifurcated, between a well-educated, older, and affluent population and a growing rank of people with little chance to ever buy a house or move solidly into the middle class. This has led to saturated migration of people to places where opportunities are more likely to present themselves. It’s fortunate that removal van hire is inexpensive nowadays. But it is hoped that this imbalance will be addressed in the future.

Ironically, these divergences are taking place precisely in those places where political rhetoric over inequality is often most heated and strident. Progressive attempts, such as raising minimum wages, attempt to address the problem, but often other policies, notably strict land-use regulation, exacerbate inequality.

The other major divide is not so much between regions but within them. Even in expensive regions, middle class families tend to cluster in suburban and exurban areas, which are once again growing faster than areas closer to the core. Progressive policies in some states, such as Oregon and California, have been calculated to slow suburban growth and force density onto often unwilling communities. By shutting down the production of family-friendly housing, these areas are driving prices up and, to some extent, driving middle and working class people out of whole regions.

To address the rise of ever more bifurcated regions, we may need to return to policies reminiscent of President Franklin Roosevelt, but supported by both parties, to encourage dispersion and home ownership. Without allowing for greater options for the middle class and ways to accumulate assets, the country could be headed not toward some imagined social democratic paradise but to something that more accurately prefigures a new feudalism.

AMERICA’S HOUSING CRISIS: A PRIME CAUSE FOR INEQUALITY

As demonstrated in a recent report from Chapman University’s Center for Demographics and Policy, housing now takes the largest share of family costs, while expenditures on food, apparel, and transportation have dropped or stayed about the same.1 In 2015, the rise in housing costs essentially swallowed savings gains made elsewhere, notably, savings on the cost of energy.2 And despite a slowing economy, the real estate consultancy Zillow predicts housing inflation will only worsen this year.3

Figure 1: Percent Share of Average Annual Expenditures per Consumer Unit 1984-2013

Source: “The Evolving Expenditures of U.S. Households,” Townhall Finance, March 26, 2015,http://finance.townhall.com/columnists/politicalcalculations/2015/03/26/the-evolving- expenditures-of-us-households-n1976354/page/full

Driven in part by potential buyers being forced into the apartment market, rents have risen to a point that they now compose the largest share of income in modern U.S. history, an often devastating blow to working class families.4 Since 1990, renters’ income has been stagnant, while inflation-adjusted rents have soared 14.7%.5 Given the large shortfall in housing production—down not only since the 2007 recession but also by almost a quarter between 2011 and 2015—the trend towards ever higher prices and greater levels of unaffordability seems all but inevitable.6 In Los Angeles County, the nation’s largest, these high rents have forced as many as 200,000 people to live in often illegal housing, such as converted garages, “bootleg” apartments, recreational vehicles, and backyard sheds. The county’s shortfall of low- income housing has been estimated as high as a half million units.7

Figure 2: The Affordability Crunch

Source: Mike Krieger, “The Oligarch Recovery – Renting in America Is Most Expensive Ever,” Zero Hedge, August 14, 2015,http://www.zerohedge.com/news/2015-08-14/oligarch-recovery-renting-america-most-expensive-ever

The connection between growing inequality and rising property prices is fairly direct. Thomas Piketty, the French economist, recently described the extent to which inequality in 20 nations has ramped up in recent decades, erasing the hard-earned progress of previous years in the earlier part of the 20th century. After examining Piketty’s groundbreaking research, Matthew Rognlie of MIT has concluded much of this change can be traced from redistribution of housing wealth away from the middle and working class to the rich and investors.8

Rognlie also found that much of this was due to land regulation and suggested the need to expand the housing supply and reexamine the land-use regulation that he associates with the loss of middle class wealth. Yet in much of the country, housing has become so expensive as to cap upward mobility, forcing many people to give up on buying a house and driving many—particularly young families—to leave high-priced coastal regions for less expensive, usually less-regulated markets in the country’s interior, even though it’s easier than ever to find the best mortgage rates to help those who are interested in to navigating the housing market.

THE RISE OF THE EXCLUSIONARY REGION

The regions with the deepest declines in housing affordability notes William Fischel, an economist at Dartmouth College, generally employ stringent land-use regulations, a notion recently seconded by Jason Furman, chairman of President Obama’s Council of Economic Advisors.9 In 1970, for example, housing costs adjusted for income were similar in coastal California and the rest of the country. Today, house prices in places like San Francisco and Los Angeles are up to three or more times as high, when adjusted for income, than most other metropolitan areas. For most new buyers, such metropolitan areas are becoming exclusionary regions for all but the most well- heeled new buyers.10

Figure 3: US Middle-Income Housing Affordability

Source: US Census Bureau, Harvard University and Demographia data

Regulations frequently diminish the supply of housing, particularly single-family homes. In a recent examination of permits across the nation from 2011 to 2014 for Forbes, we found that California, the epicenter of strict land-use regulations, lags well behind the national average in terms of new housing production, both multi-family and single-family. Houston and Dallas-Fort Worth, areas with less draconian regulations, issued three times as many permits per capita last year. Overall, California’s rate of new permits is 2.2 per 1000 residents, while across the Lone Star state the rate was nearly three times higher.11Perhaps the most severely impacted has been the Bay Area—The epicenter of the state’s tech industry, which added 480,000 jobs over the past decade but only built 50,000 new units.12

Figure 4: New Houses Building Permits

Source: US Census Bureau data

California is an extreme case, but one that has national significance. Under California’s current regime, state laws and regulations have pre-empted local political authority, particularly under Senate Bill 375. By setting up greenhouse gas emissions goals as prepatory local policies, the state has now abrogated to itself to control land use and zoning across the state.13

The state has determined that the key to reducing greenhouse gas lies in essentially getting people to change their lifestyles from predominately suburban to dense, urban, and transit dependent. Although these policies, as described above, have stimulated much local opposition, even from progressive-minded communities such as Davis and Marin.14 In the Bay Area, planners now mandate that all growth in the next 25 years will take place on 4% of the land, essentially contrary to the largely suburban growth that has characterized the region. It’s hard to see how this approach will do anything but spike real estate prices even higher.15

Yet what has received little attention is actually how effective these regulatory policies have been. For one thing, the restrictions on housing development—including urban growth boundaries, fees, and extensive controls on density and transportation improvements—have led to soaring house prices, even in places with modest economic growth, and high energy prices. The result has been to make California—a state with enormous natural and human resources—the state with the worst housing cost adjusted poverty rate in the country16 and home to roughly one-third of all welfare recipients.17

As land and regulatory costs have surged along both coasts, high land prices have made it all but impossible to build much of anything except luxury units. Many developers, particularly in “exclusionary” regions, find themselves forced to build predominately for the affluent; the era of the Levittown-style “starter home”—which particularly benefited younger families—is all but defunct.18 The rest of the country has also seen a drop in middle income housing affordability, with more production of luxury houses.19

In Manhattan, this has taken the form of high-rise towers gobbled by the rich, including many foreigners, but this new construction has done little to make New York affordable for most residents. Between 2010 and 2015, Gotham rents increased 50%, while incomes for renters between ages 25 and 44 grew by just 8%. 20

BEYOND POLITICS: MAKING OF TWO AMERICAS

Inflated housing costs are fostering the creation of two divergent Americas, one that is largely childless and has a small middle class and another that, more like pre-1990 America, still has a large middle class and children. H.G. Wells foresaw this new division over a century ago, with city cores evolving into “essentially a bazaar, a great gallery of shops, and places of concourse and rendezvous.”21 Such places would appeal to the wealthy, the artful and, most particularly, the childless who could enjoy “all the elaborate furnishing and appliances of a luxurious extinction.”22

Today, following the notion of “elegant extinction” our dense urban cores are becoming increasingly “kiddie-free zones.” Around our Central Business Districts (CBDs), according to 2011 Census figures, children between ages 5 and 14 constituted about 5.3% of the population, less than half the level seen in newer suburbs and exurbs. Overall during the last decade, the urban core population aged 5 to 14 dropped by 600,000, almost three times the net gain of 200,000 residents aged 20 to 29.23

Figure 5: Age 5-14 Population % by Urban Sector

Source: US Census Bureau data

Urban theorist Terry Nichols Clark of the University of Chicago suggests that the “new American metropolis” revolves around a dramatically “thinner family,” often without children, and those who prefer a childless lifestyle.24 For example, the highest percentage of U.S. women over age 40 without children—a remarkable 70%—can be found in Washington, D.C. In Manhattan, singles make up half of all households. In some central neighborhoods of major metropolitan areas such as New York, San Francisco, and Seattle, less than 10% of the population is made up of children under 18.

San Francisco, home now to 80,000 more dogs than children, and where the percentage of children has dropped 40% since 1970, epitomizes these trends.25 In 1970, children made up 22% of the population of San Francisco. Four decades later, they comprised just 13.4% of San Francisco’s 800,000 residents. Nearly half of parents of young children in the city, according to 2011 survey by the Mayor’s office, planned to leave in the next three years.26

In contrast, familial America clusters largely in newer suburbs and exurbs, and increasingly in the lower-cost cities in the south, the Intermountain West, and especially in Texas, which has gained many residents and businesses from more expensive states.27 Families with children are also settling instead in small, relatively inexpensive metropolitan areas, such as Fayetteville in Arkansas and Missouri; Cape Coral and Melbourne in Florida; Columbia, South Carolina; Colorado Springs; and Boise.28

Planners, urban intellectuals, and much of the media long have regarded suburbs and low-density cities with disdain. Historian Becky Nicolaides suggests that whatever their other differences, intellectuals generally agreed about suburbia: “The common denominator was hell.”29 Modern critics have blamed suburbs for everything from climate change to the collapse of culture and mental health.30 In their condemnation of suburban living, the critics have also taken aim at the preferences of much Americans. Roughly four in five American home buyers, according to a 2011 study conducted by the National Association of Realtors and Smart Growth America, prefer a single- family home.31

Figure 6: Housing Preferences, Realtors Survey

Source: US Census Bureau data

Nor does this desire seem to be fading. To be sure, suburban growth slowed in the immediate aftermath of the recession, after having been driven artificially high by the loose mortgage lending standards during the housing bubble. The real estate-tracking website Trulia reported that between 2011 and 2012, ZIP codes that were less dense than average grew at double the rate of those that were more dense than average in the 50 largest metropolitan areas. By 2013, urban core growth, which had been about as fast as suburban growth, once again slipped behind suburbs and exurbs.32 These trends intensified by 2014, with the biggest growth in exurban areas, repeating the patterns that had existed before the crash.33

At the same time, the fastest city growth, noted economist Jed Kolko, is now taking place in what residents consider the most “suburbanized” areas, like Phoenix, San Antonio, and San Diego.34 By 2014, single-family homes accounted for 61% of the total growth, only slightly less than the annual average over the past four decades.35 “Americans,” Kolko wrote, “still love the suburbs.”36

Figure 7: Exurbs are Growing Faster Than Urban Core Again

Source: The Brooklings Institution, U.S. Census Bureau

Fundamentally, America remains a suburban nation, and seems likely to remain that way. Since 1950, suburbs have accounted for over 90% of all growth in metropolitan America. 44 million Americans live in the core cities of the nation’s 51 major metropolitan areas, while nearly 122 million live in the suburbs. And this does not include the more than half of the core city population that live in districts, particularly in the Sunbelt, that are functionally suburban or exurban.37

Figure 8: Core Municipality Share of Growth

Source: US Census Bureau data

WHERE INEQUALITY IS WORST

In the past, core cities were the places where people sought to improve their lives and those of their families. A great city, wrote Rene Descartes in the 17th century, represented “an inventory of the possible,” a place where people could create their own futures and lift up their families.38 But increasingly, our most successful cities now follow the scenario laid out by author Alan Ehrenhalt in The Great Inversion.39 A return to an earlier kind of urbanism, with the rich clustered in the center and the hoi polloi—who can’t afford to live decently in the city—serving them from the dull, dreary periphery.40

Today, much like their aristocratic predecessors, the wealthiest Americans often enjoy the option of living in spacious townhomes or large city apartments, as opposed to crowded ones in less appealing areas. They could also purchase country houses for a break from the pressures of urban life.41 What suburbanization accomplished, argues historian Bob Bruegmann, was to provide the “surest way” for broader portions of the population “to obtain some of the privacy, mobility and choice that once were available only to the wealthiest and most powerful members of society.”42

To dismiss suburbia and force densification tends to reinforce inequality, which tends to be far more pronounced in larger, denser core cities. New York City, the densest and most influential urban environment in North America, exhibits the most profound level of inequality and the most bifurcated class structure in the United States. If it were a country, New York City overall would have the 15th highest inequality level out of 134 countries, according to James Parrott of the Fiscal Policy Institute, landing between Chile and Honduras.43 New York’s wealthiest 1% earn a share roughly twice as large of the local GDP than in the rest of country.44

To dismiss suburbia and force densification tends to reinforce inequality, which tends to be far more pronounced in larger, denser core cities. New York City, the densest and most influential urban environment in North America, exhibits the most profound level of inequality and the most bifurcated class structure in the United States.

While many elite professionals cluster in cities, scores of others earn their livings by serving the wealthy as, for example, nannies, restaurant workers, or dog-walkers, among other service professions. This can be seen in the city of New York, where over one-third of workers labor in low-wage service jobs, a percentage that has increased steadily throughout the recovery, notes a recent study by the Center for an Urban Future.45

Other major cities, notes a 2014 analysis data by the Brookings Institution, have seen the percentage of middle income families in a precipitous decline for the last 30 years. With the exception of Atlanta, virtually all the most unequal cities are large and dense places celebrated by many retro-oriented urbanists, notably New York, Los Angeles, and Chicago.46

Figure 9: Inequality Levels Across Nation’s Largest Cities (highest)

Source: Brookings Institution analysis of 2012 American Community Survey data

Much has been written about the impressive gentrification in parts of Chicago, but over recent years, Chicago’s middle class has declined precipitously, as analyst Daniel Hertz has demonstrated.47 At the same time, despite all the talk about ‘the great inversion’ of the poor being replaced by the rich, it turns out that it is mostly the middle and working classes that have exited the city. Urban analyst Pete Saunders has suggested Chicago is really now two different cities: a generally prosperous “super-global Chicago” and a “rust belt Chicago,” with lagging education and income levels. “Chicago,” Saunders suggests, “may be better understood in thirds—one-third San Francisco, two- thirds Detroit.”48

This is a common malady in big city America. During the first 10 years of the new millennium, the number of neighborhoods with entrenched urban poverty actually grew, increasing from 1,100 to 3,100, and in population from two to four million. “This growing concentration of poverty,” notes urban researchers Joe Cortright and Dillon Mahmoudi, “is the biggest problem confronting American cities.”49

In contrast, research by the University of Washington’s Richard Morrill shows that suburban areas, despite their own growing share of poverty, tend to have “generally less inequality” than the denser areas.50 For example, in California, Riverside-San Bernardino is far less unequal than Los Angeles, and Sacramento less so than San Francisco. Within the 51 metropolitan areas with more than 1 million in population, notes demographer Wendell Cox, suburban areas were less unequal (measured by the Gini coefficient) than the core cities in 46 cases.51 And overall, the poverty rate for cities is close to 20%, almost twice that of suburban areas.52

Figure 10: U.S. Poverty Rate by Residence Area Type, 1967-2012

Source: U.S. Census, Current Population Survey data

Figure 11: Income Equality in Major Metropolitan Areas by City Sector, 2011

Source: American Community Survey 2009-2013 City Sector Model

Data from the recent Pew Research Center report “America’s Shrinking Middle Class,” illustrates these trends. Particularly revealing has been the performance of Texas cities compared to those on the coast between 2000 and 2014. Out of the 52 metropolitan areas with more than 1,000,000 population, San Antonio had the second largest gain in its share of combined middle-income and upper- income households (in other words, the percentage of households in the lower-income segment dropped.) Houston ranked 6th. A modest loss was posted in Austin, which ranked 13th, while Dallas- Fort Worth placed in the top half, at 25th. Texas ranked 10th among the states, with a gain in its combined middle-income and upper- income segments, while California ranked 26th and saw a decrease in its combined middle-income and upper-income population. The performance of Texas is particularly impressive given that it absorbed more than 1.6 million foreign-born citizens over the period. This is slightly less than California, however in proportion to its population is 60% more.*

* Calcuated from 2015 NAEP scores. http://nces.ed.gov/nationsreportcard/statecomparisons/

THE OWNERSHIP IMPERATIVE

Land ownership is closely entwined with geography: Whereas roughly a quarter of urban core residents own their own homes, over three- fifths of residents in older suburbs and more than seven in 10 of those in newer suburbs and exurbs own theirs.53 In contrast, renters make up a majority of residents in the cores of our 11 largest cities.54

Home ownership is critical to the future of the middle class and our democracy. “A nation of homeowners,” President Franklin D. Roosevelt believed, “of people who own a real share in their land, is unconquerable.”55 New Dealers, and many Republicans, encouraged both the dispersion of population and an increase in home ownership through various legislative acts, including the creation of the Federal Housing Administration (FHA) and the Federal National Mortgage Association, (Fannie Mae), and later through the GI bill, which provided low-interest loans to returning veterans.56 Almost half of suburban housing, notes historian Alan Wolfe, depended on some form of federal financing.57

The era of the most rapid suburbanization—the period roughly from the late 1940s to the late 1960s—also saw the rapid expansion of the middle class, while that of the wealthiest actually fell.58 By the mid-1950s, the percentage of households earning middle incomes had doubled to 60%, compared with the boom years of the 1920s. By 1962, over 60% of Americans owned their own homes. The increase in home ownership, notes historian Stephanie Coontz, between 1946 and 1956 was greater than that achieved in the preceding century and a half.59 Even though the rate has dropped since the Great Recession, it remains high by historical standards.

Figure 12: Home Ownership Rate, 1900-2014

Source: U.S. Census Bureau

Ownership provided a cornerstone in this process. As sociologist Robert Lynd noted: “The characteristic thing about democracy is its diffusion of power among the people.”60

Even today, the house remains the last great asset of the middle class. Homes represent only 9.4% of the wealth of the top 1% but 30% for those in the upper 20%, and, for the overall 60% of the population in the middle, roughly 60%.61

Some have suggested in the aftermath of the 2007-8 housing bust that home ownership had outlived its usefulness. Urban pundit Richard Florida foresaw the emergence of a new paradigm that would not only dispel the “suburban myth,” but eject home ownership itself from its “long-privileged place” at the center of the U.S. economy.62 Similarly, New York Times economics commentator Paul Krugman suggested that Americans would shift from owning suburban homes to renting apartments, probably in locations close to the city core.63 Wall Street, which helped create the housing crisis, seemed happy to go along, hoping to make new profits in what some hailed as “rentership society.”64

Figure 13: What Do American’s Own? Makeup of Assets by Household Wealth, 2010

Source: Edward Wolff, The Asset Price Meltdown and the Wealth of the Middle Class, 2012; Jordan Weissman, “The Recession’s Toll: How Middle Class Wealth Collapsed to a 40-Year Low,” The Atlantic, December 4, 2012,http://www.theatlantic.com/business/archive/2012/12/the-recessions-toll-how-middle-class-wealth-collapsed- to-a-40-year-low/265743/.

Yet is the desire for ownership now utterly passé? Research for the Woodrow Wilson Center has indicated that home ownership was generally considered more important after the housing bubble than it was before—even after the damaging housing crisis, Americans still continued to sanctify home ownership. A survey by The New York Times found that nine out of 10 Americans value home ownership as a critical part of the “American dream.”65

Critically, home ownership is embraced by two groups, minorities and Millennials, who will shape our future. Millennials may be staying in the city longer than previous generations, but their long-term aspirations remain fixed on buying a single-family house.66 A survey by the online banking company TD Bank found that 84% of renters aged 18 to 34 intend to purchase a home in the future. Still another, this one from Better Homes and Gardens, found that three in four saw home ownership as “a key indicator of success.”67

Figure 14: Percent who Agree “home ownership is an important part of the American Dream”

Source: Merrill Lynch – Age Wave, 2014

Millennials are proving more like their parents in their purchases than commonly assumed. The National Association of Realtors surveyed the housing types that had been purchased by home buyers in 2013 and 2014. They found that 80% of Millennial buyers had purchased detached houses, and 8% had chosen attached housing. Only 7% purchased units in multi-unit buildings, although many more, unable to buy, do end up renting in high-density buildings longer than they expect.68

Figure 15: House Purchases Under Age 35

Source: National Association of Realtors, 2015

In recent years, Millennials, seeking reasonable rents and the possibility of purchasing a home, have also begun to move to more affordable areas. According to Zillow, Millennials in the workforce now see rents claim upwards of 45% of income in Los Angeles, San Francisco, New York, and Miami compared to less than 30% of income in places like Dallas-Fort Worth and Houston.69 The costs of purchasing a house are even more lopsided: in Los Angeles and the Bay Area, a monthly mortgage takes, on average, close to 40% of income, compared to 15% nationally.70

The regulatory regime exacts an enormous price on the younger generation. A recent account by the magazine Techcrunch traced the percentage of income paid by generation in California. Those born in 1960 pay roughly 30% of their income on housing, while those born after 1980 generally pay closer to 40 to 50%.71

Figure 16: Younger Generations Spend More of Their Income on Housing

Source: Brian Uhler, “Generational Differences in Homeownership and Housing Costs,” Legislative Analyst’s Office, The California Legislature’s NonPartisan Fiscal and Policy Advisor, August 17, 2015, http://lao.ca.gov/ LAOEconTax/article/detail/120

This is leading to a renewed shift away from traditional “brain magnets” like New York, Los Angeles, and the Bay Area. Since 2010, even among educated Millennials, migration has been strongest to such lower-cost regions as Atlanta, Orlando, New Orleans, Houston, Dallas-Fort Worth, Pittsburgh, Columbus, and even Cleveland.72 As Millennials enter their 30s and seek to buy houses, these changes are likely to accelerate.

Figure 17: Changing Migration of Millennials

Source: Richey Piiparinen, Jim Russell, and Charlie Post, “The Fifth Migration,” The Cleveland Foundation, January 20, 2016,https://www.clevelandfoundation.org/2016/01/the-fifth-migration/

These newcomers have accounted for roughly two out of five in the growth of home ownership. In relatively slow-growing California, they represent four out of five new buyers. In New York, the immigrant portion of housing growth is two-thirds. It is 30% in Georgia and 25% in North Carolina.73 Roughly 60% of Hispanics and Asians already live in suburbs; more than 40% of non-citizen immigrants now move directly to suburbs.74,75Between 2000 and 2012, the Asian population in suburban areas of the nation’s 52 biggest metro areas grew 66.2%, while that in the core cities expanded by 34.9%.76 Of the top 20 cities with an Asian population of more than 50,000, all but two are suburbs.77

Much of this growth is concentrated in “opportunity regions”—such as in Texas and the Southeast—where house prices are more accessible to minorities. In these less-regulated regions, minorities tend to have a far greater chance of achieving home ownership than in the more expensive, highly regulated environments of New York, San Francisco, Seattle, or Boston.

Figure 18: Home Ownership Rate, 2012

Source: U.S. Census American Community Survey, 2012

Overall, the geography for upward mobility is changing. As the Urban League has pointed out, the very cities most praised as exemplars of urban revival—San Francisco, Chicago, and Minneapolis—also suffer the largest gaps between black and white incomes.78Notwithstanding rhetoric to the contrary, much of the ‘hip cool’ world increasingly consists of monotonic “white cities” with relatively low, and falling, minority populations.79 San Francisco, Portland, and Seattle, for instance, while achingly politically correct in theory, are actually becoming whiter and less ethnically diverse as the rest of the country diversifies.80

THE DENSITY DELUSION

Planners, retro-urbanists, and many developers believe the solution to the affordability crisis is higher-density housing in cities and suburbs. The problem facing big coastal cities, notes one progressive blogger, is their lack of “semi-density, mid-rise construction.”81 Yet it turns out that, by most measurements, higher density housing is far more expensive to build. Gerard Mildner, the Academic Director of the Center for Real Estate at Portland State University, notes that a high rise over five stories costs nearly three times as much per square foot as a garden apartment.82 Even higher construction costs are reported in the San Francisco Bay Area, where townhome developments can cost up to double that of detached houses per square foot to build (excluding land costs), and units in high-rise condominium buildings can cost up to 7.5 times as much.83

Figure 19: Cost by Construction Type, San Francisco Bay Area

Source: FBI Statistics 2013, Major metropolitan areas (average).

Figure 20: Metropolitan Average Annual Earnings Adjusted for Cost of Living and Home Values

Sources: EMSI 2015.2 Employment Data, U.S. Bureau of Economic Analysis Regional Price Parities, U.S. Census American Community Survey

Some researchers insist that, despite higher costs, dense urban places deliver outsized benefits to their denizens, including the poor and minorities.84 Yet this research only focuses on places where people grew up, not where they have moved. The overreach was challenged by Columbia University urban planning professor David King, who pointed out that the highest-ranked cities in the upward mobility analysis were all “sprawling,” including Salt Lake City, Santa Barbara, and Bakersfield, which he referred to as a “poster child for sprawl.” He further noted that: “…snapshot correlations really don’t mean anything and will provide evidence for whatever point of view is desired.”85

In reality, density and economic performance may not be as closely linked as many suggest. Much is made of the “network effects” of dense cities, yet many of the most productive cities have very low population densities. For example, in 2014, nine of the 10 most affluent cities, according to Brookings Institution data, were in the United States, and all were low-density by international standards. Second-ranked Hartford, fourth-ranked Bridgeport and sixth-ranked Boston all had urban densities approximately one-quarter or less that of European urban areas. The metropolitan areas with the highest urban densities, San Jose (3rd) and San Francisco (9th) and New York had urban densities at least one-quarter less than that of their European counterparts.86 Despite these findings, some pundits and planners are so enamored of the idea of density as an economic driver, they have actually proposed that millions of Americans desert the suburbs or struggling cities and crowd into places like San Francisco.87

High-cost metropolitan areas will continue to play a critical role in our economic life, but, for the most part, will not constitute places of upward mobility for most middle and working class Americans. Dense urban environments are well-suited for many industries most reliant on regular “face to face” contact, such as media, high-end finance, and business services. But these fields are far less reliant on the mass mobilization of labor, both skilled and unskilled, than activities in manufacturing, trade, logistics or even more routine business services. Given their bifurcated labor markets and generally high costs, many ‘hip’ cities, such as New York, Los Angeles, and Portland, do not return the same overall economic benefits as those in less expensive cities.

At the same time, many of the functions of urban-centered sectors, such as finance and business services, have tended to shift their management and support services to other, less expensive regions.88 Other traditional business service locales like San Francisco, Boston, and Chicago also did poorly in creating finance employment, while growth was most rapid in second- and third-tier cities such as Charlotte, Des Moines, Austin, San Antonio, and Boise. Big money and financial power may remain concentrated in Gotham, but jobs, particularly for the middle income worker, increasingly are not.89

Notable moves by large companies to downtown areas, analyst Aaron Renn has suggested, have very limited effects on job creation. Many relocating firms often limit their presence to “executive headquarters” where they employ a small number of very senior leaders and their support staff. Sometimes less than a hundred employees are involved, as opposed to the thousands that might have been located in a downtown headquarters decades ago.90 Overall, the movement of elite operations to Chicago has done something for morale and image, but little in terms of job generation, particularly for the middle and working classes.91

Figure 21: Finance Industry Growth, 2001-2014

Source: EMSI 2015.2

GE’s recent decision to leave Connecticut for Boston follows this elite-driven economy; while moving away from its roots as a manufacturing firm, the company has focused on a relatively small population of high-end programmers and developers as the core of their future business.92 In contrast, firms that maintain large employment bases—for example Toyota— have moved to less expensive locales, in their case to suburban Dallas-Fort Worth, in large part to lower costs, particularly for housing employees.93

Meanwhile, suburbs have risen into major job centers that rival the core cities.94 Some predominately suburban areas—Irvine and Silicon Valley in California; Bellevue, outside of Seattle; and Irving, a Dallas suburb—have higher job-to-resident worker ratios than their closest core municipality.95 This dispersion of work applies even in the oft-cited model for urban density, Portland, Oregon, where all the net new job growth was clustered in the suburbs and exurbs between 2000 and 2013.96

Figure 22: Employment % Share by Urban Sector, San Francisco

Source: Wendell Cox, based on U.S. Census data

Nationwide, as the economy has improved, suburban locations—which account for more than 75% of all office space—started to rebound faster than their more urban counterparts. Between 2012 and 2015, occupied suburban office space rose from 75% of the market to 76.7% (with the balance located in CBDs).97 More than 80% of employment growth from 2007 to 2013 was in the newer suburbs and exurbs.98 Today, only 9% of employment is located in the CBDs, with an additional 10% in the balance of the urban cores.99

Some claim that tech is now becoming an inner-city industry, bolstered by Millennial preferences for inner-city living.100 San Francisco proper has seen a significant boom in high-tech business services in recent years, yet the majority of the Bay Area’s total employment remains more than 10 miles from the city. Neighboring San Mateo County still holds more than five times as many jobs in software publishing as San Francisco.101 The Bay Area’s employment dispersal is even greater than the national average.102

Figure 23: Suburbs Dominate Job Growth

Source: City Sector Model Calculated from Census Bureau data

Most STEM employment—jobs in science, technology, engineering, or math—remains firmly in overwhelmingly suburbanized areas with lower-density development and little in the way of transit usage.103 Urban areas as diverse and low density as Raleigh and Durham, North Carolina; Madison, Wisconsin; Denver; Detroit; Baltimore; Colorado Springs; and Albany are among the places with the highest shares of STEM jobs. Many of these same unassuming regions are creating new STEM jobs faster than the high-tech stalwart locations. Charleston, South Carolina; Provo, Utah; Fayetteville, Arkansas; Raleigh, North Carolina; and Des Moines round out the fastest- growing STEM regions since 2001, each with STEM employment up at least 29%.104

Figure 24: STEM Job Growth, 2001-2014

Source: EMSI 2015.2

BUILDING A FUTURE FOR MIDDLE CLASS FAMILIES

Some suggest that Americans, for the sake of the environment and even social justice, accept a lower standard of living, giving up their cars and homes for the pleasure of riding transit and living in small, congested places. One retro-urbanist author, David Owen, in his book Green Metropolis suggests that the planet needs to live in densities associated with his former Manhattan home, although he himself moved to bucolic Connecticut.105

Although there is a pressing need to address climate issues, it seems clear that this can be done without such extreme social engineering.

Indeed much of the research advocating density as a solution to climate change is deeply flawed, since it usually excludes GHG emissions from common areas, including elevators, and from lighting fixtures, space heaters, and air conditioners, usually because data is not available. Indeed, one recent study from the National Academy of Sciences found that the New York metropolitan area, despite its transit system and high density, was the most environmentally unfriendly of the world’s 27 megacities, well ahead of more dispersed, car-dominated Los Angeles, measured in terms of energy use and material flows per capita.106

Forcing higher densities, according to data in a recent National Academy of Sciences report, can do relatively little—perhaps as little as 2%—to reduce the nation greenhouse gas emissions: “Urban planners hoping to help mitigate CO2 emissions by increasing housing density would do better to focus on fuel-efficiency improvements to vehicles, investments in renewable energy, and cap and trade legislation,” they note.107 Economist Anthony Downs of the Brookings Institution, a proponent of smart-growth policies, has said, “If your principle goal is to reduce fuel emissions, I don’t think future growth density is the way to do it.”

As Downs suggests, there may be other, more effective and less damaging ways to reduce emissions. Improved mileage on cars, including electric and natural gas or hydrogen-propelled vehicles, would thus be far more impactful, not to mention less disruptive.108

A report by McKinsey & Company and the Conference Board indicates that sufficient greenhouse gas emissions could be achieved without any “… of the draconian changes in living standards and lifestyles widely promoted by smart-growth advocates.”109

Rather than try to squelch middle class aspirations, perhaps there should be more emphasis on making them more environmentally friendly. The shift to home-based work, which is now growing far faster than transit use, directly addresses some environmental problems often associated with suburbs, notably issues around auto commuting. The environmental savings related to reducing office energy consumption, roadway repairs, urban heating, office construction, business travel, and paper usage (as electronic documents replace paper) could also be prodigious.110

Figure 25: Change in Work Trip Travel Mode, United States: 2000 to 2010

Source:Mark Schill, Praxis Strategy Group, http://www.praxissg.com/projects

Critically, Millennials, notes a recent Ernst and Young study, embrace telecommuting and flexible schedules more than previous generations did, in large part due to concerns about finding balance between work and family life.111 This is particularly true of entrepreneurs. A 2012 survey of 3,000 Millennial-generation business owners found that 82% believe that many businesses will be built entirely with virtual teams of online workers by 2022.112

NEEDED NOW: ECO-MODERNIST LEVITTOWNS

Ultimately, the prospect of being able to buy or rent an affordable place to live represents a critical issue in assuring future social justice in America. Without access to affordable, usually suburban homes, working and middle class families face a somewhat dismal future. Draconian attempts to limit or even eliminate suburban growth would guarantee that people without wealth will be hard-pressed to achieve upward mobility.113

Rather than impose one solitary ideal, we should embrace what Robert Fishman described nearly three decades ago as “urban pluralism” that embraces not only the city center, but also close-in suburbs, new fringe developments, and exurbs.114 Frank Lloyd Wright once noted that the city should not be a device to “destroy the citizen” and his affiliations, but instead, to serve as a “means of human liberation.” Cities, he suggested, should be judged on how they meet the needs of citizens for privacy, for space, and for fostering strong communities through associations, churches, and family ties.115

Such an approach differs distinctly from the growing imposition by planners and political forces of what one critic labels “proscriptive policies and social restraint on the urban form.”116 One strong smart growth advocate suggests siphoning tax revenues from suburbs to prevent them from “cannibalizing” jobs and retail sales, and to “curb sprawl” in order to recreate the imagined high-density community of the past, with heavy transit usage and main streets that have housing over the shops.117

Instead of tailoring our future to meet the preferences of a relative handful of those who prefer density, perhaps we can focus on addressing the aspirations of the many. One approach would be to draw on the successful policies enacted after World War II. At that time, the nation suffered a severe housing crisis as servicemen returned from the war. The solution combined governmental activism—through such things as the GI Bill and mortgage interest deductions—with less regulatory control over development. The result was a massive expansion of the country’s housing stock and a dramatic increase in the level of home ownership.

These new suburbs, as well as in-fill projects, could open up the housing market to more minorities and Millennials, while serving to lessen the burden on rents. These new suburbs—as well as older ones—could be adapted to encourage such environmentally beneficial aspects as home-based work, solar power, bicycling, and open spaces without undermining the fundamental attractions of lower-density living.

CONCLUSION

How we deal with the housing crisis will shape our future and will largely determine what kind of nation we will become. Attempts to subsidize new units in such diverse places as San Francisco, New York, and San Jose have not altered significantly market dynamics and might also have driven up prices for nonsubsidized units.118 In some cases, as in New York City, the forced construction of low-income units in otherwise market-rate buildings has resulted in such absurdities as the so-called “poor door” through which low-income residents, who are denied most of the amenities offered to wealthier residents, must enter.119

The “poor door” option marks, at very least, a shift from the expanded ownership model represented by Levittown and its many analogues across the country. Following our current path, we can expect our society—particularly in deep blue states—to move ever more towards a kind of feudalism where only a few own property while everyone else devolves into rent serfs. The middle class will have little chance to acquire any assets for their retirement, and increasingly few will choose to have children. Imagine, then, a high- tech Middle Ages with vast chasms between the upper classes and the poor, with growing dependence—even among what once would have been middle class households—on hand-outs to pay rent. Imagine too, over time, Japanese-style depopulation and an ever more rapidly aging society.

Yet, none of this is necessary. This is not a small country with limited land and meager prospects. A bold new approach to housing, including the reform of out-of-control regulations, could restore the fading American dream for tens of millions of families. It would provide the basis for a greater spread of assets and perhaps a less divided—and less angry—country. Rather than waste their time on symbolic issues or serving their financial overlords, our political and business leaders need to address policies that are now undermining the very basis of our beleaguered middle class democracy.

ABOUT THE AUTHOR

Kotkin is the Presidential Fellow in Urban Futures at Chapman University in Orange, California and Executive Director of the Houston-based Center for Opportunity Urbanism (opportunityurbanism.org). He is Executive Editor of the widely read websitewww.newgeography.com and writes the weekly “New Geographer” column for Forbes.com. He serves on the editorial board of the Orange County Register and writes a weekly column for that paper, and is a regular contributor to the Daily Beast and Real Clear Politics.

He is the author of seven previously published books, including the widely praised The New Class Conflict (Telos Press), which describes the changing dynamics of class in America.

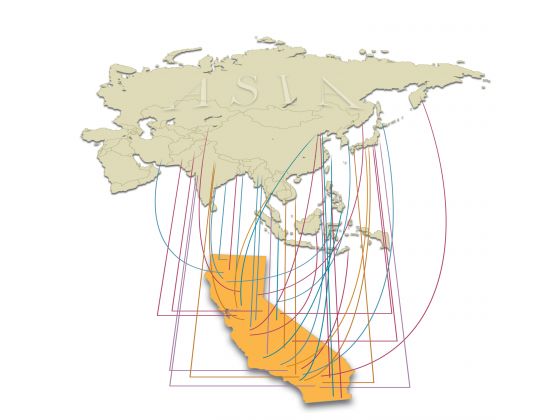

Over the past decade, Kotkin has completed studies focusing on several major cities, including a worldwide study focusing on the future of London, Mumbai, and Mexico City, and studies of New York, Los Angeles, New Orleans, Houston, San Bernardino, and St. Louis, among others. In 2010 he completed an international study on “the new world order” for the Legatum Institute in London, UK, that traced trans-national ethnic networks, particularly in East Asia. He also has worked in smaller communities, including a report— working with Praxis Strategy Group—on the rise of the Great Plains for Texas Tech University.

Currently, Kotkin is coordinating major studies on Texas urbanism, the future of localism and the re-industrialization of the American heartland for the Center for Opportunity Urbanism. As director of the Center for Demographics and Policy at Chapman, he was the lead author of a major study on housing, and is currently involved in a project about the future of Orange County, CA.

This study was originally published by third way on 8/23/2016

Endnotes

- Joel Kotkin, Wendell Cox, Mark Schill, and Ali Modarres, “Building Cities For People,” Chapman University Center for Demographics and Policy, 2015, http://chapman.edu/wilkinson/_files/searleweb1415.pdf.

- “The Evolving Expenditures of U.S. Households,” Townhall Finance, March 26, 2015,http://finance.townhall.com/columnists/politicalcalculations/2015/03/26/ the-evolving-expenditures-of-us-households-n1976354/page/full; “Rising Housing Costs Swallow Up Savings Elsewhere,” August 20, 2015, iPR Newswire, http://ibloomberg.net/rising-housing-costs-swallow-up-savings-elsewhere/

- http://www.zerohedge.com/news/2015-08-14/oligarch-recovery-renting-america-most-expensive-everEmily Heffter, “Zillow’s 2016 Forecast: Suburban Living Heats Up,” Zillow, November 30, 2015,http://www.zillow.com/blog/zillow-2016-forecast-187561/?utm_source=email&utm_medium=email&utm_campaign=emm-0116_ buzz2016predictions-button.

- Mike Krieger, “The Oligarch Recovery – Renting in America Is Most Expensive Ever,” Zero Hedge,August 14, 2015, http://www.zerohedge.com/news/2015-08-14/oligarch-recovery-renting-america-most-expensive-ever.

- Chelsea Dulaney, “Apartment Rents Rise as Incomes Stagnate,” The Wall Street Journal, July 2, 2014, http://www.wsj.com/articles/apartment-rents-rise-as-incomes-stagnate-1404273662.

- “Building Permits Survey,” United States Census Bureau, September 25, 2015,http://www.census.gov/construction/bps/.

- Ryan Reft, “Suburban Ideals vs. New Realities: Informal Housing in South Gate,” KCET, January 12, 2016, http://www.kcet.org/socal/departures/columns/intersections/suburban-ideals-vs-new-realities-informal-housing-in- south-gate.html.

- Matthew Rognile, “A note on Piketty and diminishing returns to capital,” MIT, June 15, 2015,http://www.mit.edu/~mrognlie/piketty_diminishing_returns.pdf.

- Wendell Cox, “White House Economics Links Land Use Regulations: House Affordability and Inequality,” New Geography, December 1, 2015, http://www.newgeography.com/content/005111-white-house-economist-links-land-use-regulations-housing-affordability-and-inequality.

- William Fischel, Zoning Rules! The Economics of Land-use Regulation (Lincoln Institute of Land Policy, July 2015), 166-167.

- Joel Kotkin, “The Cities Doing The Most To Address the S. Housing Shortage,” Forbes, December 17, 2015, http://www.forbes.com/sites/joelkotkin/2015/12/17/the-cities-doing-the-most-to-address-the-u-s-housing-shortage/.

- Abigail Sindzinski, “Why Homes in Major S. Cities Are Nearly Impossible to Afford,” Curbed, January 27, 2016, http://curbed.com/archives/2016/01/27/ buying-homes-major-cities-unaffordable-new-york-san-francisco-la.php?utm_ campaign=curbed&utm_medium=social&utm_content=wednesday&utm_ source=facebook.

- “The Trouble with Senate Bill 375,” San Rafael Patch, September 15, 2013,http://patch.com/california/sanrafael/the-trouble-with-senate-bill-375

- Richard Halstead, “Officials approve controversial Plan Bay Area as Marin opponents turn out for Oakland vote,” Marin Independent Journal, July 18, 2013,http://www.marinij.com/article/ZZ/20130718/NEWS/130718856

- Zelda Bronstein, “The false promise of regional governance,” org, May 12, 2015,http://48hills.org/2015/05/12/the-false-promise-of-regional-governance/

- Michael Gardner, “Is California the welfare capital?” The San Diego Union-Tribune, July 28, 2012,http://www.sandiegouniontribune.com/news/2012/jul/28/welfare- capital-of-the-us/

- Wendell Cox, “California: ‘Land of Poverty,’” New Geography, August 21, 2015,http://www.newgeography.com/content/005026-california-land-poverty

- Les Shaver, “The Demise of the Starter Home”, Architect, April 14, 2015,http://architectmagazine.com/practice/market-intel/the-demise-of-the-starter- home_s; Megan McArdle, “New Starter Homes Hit a Dead Stop”, Bloomberg View, April 17, 2015,http://www.bloombergview.com/articles/2015-04-17/new-starter-homes-hit-a-dead-stop; Bob Sullivan, “The Death of the Starter Home,” Daily Finance, August 11, 2015,http://www.dailyfinance.com/2015/08/11/death-of-starter-homes/?icid=maing-grid7|main5|dl16|sec1_lnk3%26pLid%3D368585882.

- “Affordable Housing Stock in S. Declines as Home Prices Gain,” Economy Watch, August 12, 2014,http://www.economywatch.com/news/affordable- housing-stock-in-us-declines-as-home-prices-gain.12-08.html.

- David Winzelberg, “NAR: NY rental costs unsustainable,” com, March 16, 2015,http://libn.com/2015/03/16/nar-ny-rental-costs-unsustainable/.

- G. Wells, Anticipations of the Reaction of Mechanical and Scientific Progress Upon Human Life and Thought (Mineola, NY: Dover, 1999), 32.

- Wells, Anticipations of the Reaction, 75-76.

- Wendell Cox, “Exodus of the School Children”, New Geography, December 29, 2014,http://www.newgeography.com/content/004815-exodus-school-children; Joel Kotkin, “The Geography of Aging: Why Millennials are headed to the Suburbs”, December 9, 2013,http://www.newgeography.com/content/004084-the-geography-of-aging-why-Millennials-are-headed-to-the-suburbs.

- Terry Nichols Clark, et , “Amenities Drive Urban Growth: A New Paradigm and Policy Linkages”, inThe City as Entertainment Machine, ed. Terry Nichols Clark (Amsterdam: Elsevier, 2004), 291-318; Terry Nichols Clark and Ronald Inglehart, “The New Political Culture” in The New Political Culture,ed. Terry Nichols Clark and Vincent Hoffman-Martinett (Boulder, CO: Westview Press, 1998), 58-59.

- Norimitsu Onishi, “In City Where Dogs Outnumber Children, Finding a Way for Coyotes to Exist,”The New York Times, May 14, 2012, http://www.nytimes. com/2012/05/15/us/in-san-francisco-coyotes-in-parks-are-a-concern.html?_r=2.

- “San Francisco, California”, City-Data.com, http://www.city-data.com/city/San- Francisco-California.html; Joshua Sabatini, “San Francisco becoming a child-free zone as youth population declines”, The Examiner, March 23, 2011, http://www. com/sanfrancisco/san-francisco-becoming-a-child-free-zone-as- youth-population-declines/Content?oid=2171813; Rachel Gordon, “Many with children planning to leave city/Survey finds them upset with safety, housing, schools”, SFGATE, October 22, 2005, http://www.sfgate.com/bayarea/article/ SAN-FRANCISCO-Many-with-children-planning-to-2600243.php; “Families Flee San Francisco: City Has Lowest Percentage Of Kids Of Any Major U.S. City”, The Huffington Post, March 11, 2012,http://www.huffingtonpost.com/2012/03/09/ families-flee-san-francisco_n_1335639.html; Joe Eskenazi, “Newsflash: San Francisco Expensive, Minorities and Families Leaving”, SF Weekly,March 9, 2012, http://www.sfweekly.com/thesnitch/2012/03/09/newsflash-san-francisco-expensive-minorities-and-families-leaving; Joel Kotkin, “Aging America: The cities that are graying the fastest”, New Geography, December 14, 2012, http://www.newgeography.com/content/003314-aging-america-the-cities-that-are- graying-the-fastest.

- Mitchell Schnurman, “Thank you, California, New York, et al., for transplants keeping Texas afloat,” The Dallas Morning News, January 29, 2016,http://dallasnews.com/business/columnists/mitchell-schnurman/20160129- schnurman-thank-you-california-new-york-et-al-for-so-many-transplants-keeping- texas-afloat.ece.

- Based on net domestic migration of children aged 5-17, 2006-2010, American Community Survey 5

- Becky Nicolaides, “How Hell Moved From the Cities to the Suburbs,” in The New Suburban History,Thomas J. Sugrue and Kevin M. Kruse (The University of Chicago Press: Chicago, 2006), 98.

- Andres Duany, et al., Suburban Nation: The Rise of Sprawl and the Decline of the American Dream,(Berkeley:2000) 5-9, 137 (has not been cited previously in this document, which book?) ; William Schneider, “The Suburban Century Begins”, The Atlantic, July 1992,http://www.theatlantic.com/past/politics/ecbig/ htm.

- Ed Braddy, “Smart Growth and the New Newspeak,” New Geography, April 4, 2012,http://www.newgeography.com/content/002740-smart-growth-and-the- new-newspeak.

- Neil Shah, “Suburbs Regain Their Appeal,” The Wall Street Journal, May 22, 2014,http://on.wsj.com/28YUlEY

- Conor Dougherty, “Cities Grow at Suburbs’ Expense During Recession”, The Wall Street Journal,July 1, 2009, http://www.wsj.com/articles/SB124641839713978195; Christopher B. Leinberger, “The Death of the Fringe Suburb”, The New York Times, November 25, 2011,http://www.nytimes.com/2011/11/26/opinion/the- death-of-the-fringe-suburb.html?_r=0; Jed Kolko, “No, Suburbs Aren’t All the The Suburbiest Ones Are Growing Fastest”, The Atlantic,February 5, 2015, http://www.citylab.com/housing/2015/02/no-suburbs-arent-all-the-same-the- suburbiest-ones-are-growing-fastest/385183/; Emily Badger, “New Census data: Americans are returning to the far-flung suburbs”, The Washington Post, March 26, 2015,http://www.washingtonpost.com/blogs/wonkblog/wp/2015/03/26/ new-census-data-americans-are-returning-to-the-far-flung-suburbs/; “Seeding Sprawl”, Wall Street Journal, October 18, 2006.

- Jed Kolko, “How Suburban Are Big American Cities?”, FiveThirtyEightEconomics, May 21, 2015,http://fivethirtyeight.com/features/how-suburban-are-big-american-cities/.

- Calculated from US Bureau of the Census

- Jed Kolko, “Even After the Housing Bust, Americans Still Love the Suburbs”, Center for Opportunity Urbanism, October 11, 2012, http://opportunityurbanism. org/2015/01/even-after-the-housing-bust-americans-still-love-the-suburbs/.

- Wendell Cox, “Urban Cores, Core Cities and Principal Cities,” New Geography, August 1, 2014,http://www.newgeography.com/content/004453-urban-cores- core-cities-and-principal-cities.

- Braudel, The Perspective of the World (University of California Press: Berkeley, 1992),

- Marcus Gee, “Cities seeing a reversal of flight to the suburbs,” The Globe and Mail, October 6, 2012,http://www.theglobeandmail.com/news/toronto/marcus- gee-cities-seeing-a-reversal-of-the-flight-to-the-suburbs/article4593585/.

- Derek Thompson, “Why Middle-Class Americans Can’t Afford to Live in Liberal Cities,” The Atlantic,October 29, 2014, http://www.theatlantic.com/business/ archive/2014/10/why-are-liberal-cities-so-unaffordable/382045/; Alan Ehrenhalt, “Cities of the Future May Soon Look Like Those of the Past,” Governing, April 2012, http://www.governing.com/topics/economic-dev/gov-cities-of-future-may- soon-look-like-past.html.

- Fernand Braudel, The Structures of Everyday Life (Berkeley and Los Angeles: University of California Press), 281

- Bruegmann, Sprawl (The University of Chicago Press: Chicago, 2005), 111-112, 132.

- “More Earners at Extremes”; Sam Roberts, “Rich Got Richer and Poor Poorer in Y.C., 2011 Data Shows”, The New York Times, September 20, 2012, http://www. nytimes.com/2012/09/20/nyregion/rich-got-richer-and-poor-poorer-in-nyc-2011- data-shows.html?_r=0; C. Zawadi Morris, “New City Council Study Shows NYC’s Middle Class Shrinking Fast”, Bed-Stuy Patch, February 11, 2013, http://bed-stuy. patch.com/articles/new-city-council-study-shows-nyc-s-middle-class-shrinking- fast; Lizzy Ratner, “Boom Town and Bust City: A Tale of Two New Yorks,” The Nation, January 27, 2011,http://www.thenation.com/article/boom-town-and-bust- city-tale-two-new-yorks/.

- Patrick McGeehan, “More Earners at Extremes in New York than in U.S.,” The New York Times, May 20, 2012, http://www.nytimes.com/2012/05/21/nyregion/ middle-class-smaller-in-new-york-city-than-nationally-study-finds.html; Sam Roberts, “Income Data Shows Widening Gap Between New York City’s Richest and Poorest,” The New York Times, September 20, 2012,http://www.nytimes.com/2012/09/20/nyregion/rich-got-richer-and-poor-poorer-in-nyc-2011-data- html?_r=0; C. Zawadi Morris, “New York City Council Study Shows NYC’s Middle Class Shrinking Fast,” Patch Network, February 11, 2013, http://bed-stuy.patch.com/articles/new-city-council-study-shows-nyc-s-middle-class- shrinking-fast.

- Christian Gonzalez-Rivera, “Low-Wage Jobs, 2012”, Center for an Urban Future, April 2013,http://nycfuture.org/data/info/low-wage-jobs-2012; Patrick McGeehan, “More Earners at Extremes in New York Than in U.S.”, The New York Times, May 20, 2012,http://www.nytimes.com/2012/05/21/nyregion/middle- class-smaller-in-new-york-city-than-nationally-study-finds.html?_r=0.

- Don Lee, “From coast to coast, middle-class communities are shrinking,” Los Angeles Times, May 11, 2016, http://www.latimes.com/business/la-fi-middle-class- pew-20160511-snap-story.htmlMichael Zuckerman, “The Polarized Partisan Geography of Inequality,” The Atlantic, April 7, 2014,http://www.theatlantic.com/politics/archive/2014/04/the-polarized-partisan-geography-of-inequality/360130/

- Daniel Hertz, “Watch Chicago’s Middle Class Vanish Before Your Very Eyes,” New Geography, April 4, 2014, http://www.newgeography.com/content/004251-watch- chicago-s-middle-class-vanish-before-your-very-eyes.

- Peter Saunders, “Two Chicagos, Defined”, New Geography, December 12, 2014,http://www.newgeography.com/content/004795-two-chicagos-defined; Daniel Kay Hertz, “Watch Chicago’s Middle Class Vanish Before Your Very Eyes”, City Notes, March 31, 2014,http://danielkayhertz.com/2014/03/31/middle-class/.

- Joe Cortright and Dillon Mahmoudi, “Lost in Place: Why the persistence and spread of concentrated poverty – not gentrification – is our biggest urban challenge,” CityReport, December 2014, http://cityobservatory.org/wp-content/ uploads/2014/12/LostinPlace_12.4.pdf.

- Richard Morrill, “Inequality of the Largest U.S. Metropolitan Areas,” New Geography, September 11, 2013, http://www.newgeography.com/content/003921- inequality-largest-us-metropolitan-areas.

- Joel Kotkin, “Where Inequality is Worst in the United States,” New Geography, March 21, 2014,http://www.newgeography.com/content/004229-where- inequality-is-worst-in-the-united-states.

- “Who is poor?”, Institute for Research on Poverty, 2014, http://www.irp.wisc.edu/ faqs/faq3.htm.

- Calculated by Wendell Cox from 2010 census bureau

- Laura Kusisto and Kris Hudson, “Renters Are Majority in Big U.S. Cities,” The Wall Street Journal,February 8, 2015, http://www.wsj.com/articles/renters-are- majority-in-big-u-s-cities-1423432009?ref=/home-page&cb=logged0.80010662172 38658&cb=logged0.262065261025769.

- Crystal Galyean, “Levittown: The Imperfect Rise of the American Suburbs,” US History Scene,August 13, 2012, http://www.ushistoryscene.com/uncategorized/ levittown/.

- Eric John Abrahamson, Building Home: Howard F. Ahmanson and the Politics of the American Dream(Berkeley: University of California Press, 2013), 5.

- Stephanie Coontz, The Way We Never Were (New York: Basic Books, 1991), 77;

- Thomas Piketty and Emmanual Saez, “The Evolution of Top Incomes: A Historical and International Perspective”, American Economics Association, 2006,http://eml.berkeley.edu/~saez/piketty-saezAEAPP06.pdf.

- Coontz, The Way We Never Were, 29,

- Clarence Senior, Land Reform and Democracy (Gainesville: University of Florida Press, 1958), 11

- Jordan Weissmann, “The Recession’s Toll: How Middle Class Wealth Collapsed to a 40-Year Low,”The Atlantic, December 4, 2012, http://www.theatlantic.com/business/archive/2012/12/the-recessions-toll-how-middle-class-wealth-collapsed-to-a-40-year-low/265743/.

- Richard Florida, “How the Crash Will Reshape America”, The Atlantic, March 2009,http://www.theatlantic.com/magazine/archive/2009/03/how-the-crash- will-reshape-america/307293/?single_page=true.

- Paul Krugman, “Home Not-So-Sweet-Home”, New York Times, January 23, 2008,http://www.nytimes.com/2008/06/23/opinion/23krugman.html.

- Richard Florida, “Homeownership is Overrated”, The Wall Street Journal, June 7, 2010,http://www.wsj.com/articles/SB1000142405274870355900457525670302 1984396; Donna Westlund, “Views Differ on Transition in S. From Ownership to Rentership Society”, Guardian Liberty Voice, May 3, 2014, http://guardianlv. com/2014/05/views-differ-on-transition-in-u-s-from-ownership-to-rentership- society/.

- Jordan Weissmann, “The Recession’s Toll: How Middle Class Wealth Collapsed to a 40-Year Low,”The Atlantic, December 4, 2012, http://www.theatlantic.com/business/archive/2012/12/the-recessions-toll-how-middle-class-wealth-collapsed- to-a-40-year-low/265743/.

- Kris Hudson, “Generation Y Prefers Suburban Home Over City Condo,” The Wall Street Journal,January 21, 2015, http://www.wsj.com/articles/Millennials-prefer- single-family-homes-in-the-suburbs-1421896797?cb=logged0.7028438908287595.

- Wendell Cox, “84% of 18-to-34-Year-Olds Want to Own Homes,” New Geography, May 22, 2012,http://www.newgeography.com/content/002859- 84-18-34-year-olds-want-to-own-homes; “Study Finds 84 Percent of Renters Intend to Buy a Home”, National Mortgage Professional , May 21, 2012, http://nationalmortgageprofessional.com/news/23453/study-finds-84-percent-renters- intend-buying-home

- 68 “Home Buyer and Seller Generational Trends,” National Association of Realtors, March 2015,http://www.realtor.org/sites/default/files/reports/2015/2015- home-buyer-and-seller-generational-trends-2015-03-11.pdf?utm_source=hs_ email&utm_medium=email&utm_content=21927799&_hsenc=p2ANqtz-

_12AfxVI9zZ4mSzz8SS75C7_yXu2vbK_9e9KKi2jd3KYJUdPscTskdIYZplm6sOINV2 lWx1JJ4RaFAEtFKfjN0rWEQKg&_hsmi=21927799. - 69 Patrick Clark, “The Exact Moment Big Cities Got Too Expensive for Millennials,” Bloomberg Business, July 15, 2015, http://www.bloomberg.com/ news/articles/2015-07-15/the-exact-moment-big-cities-got-too-expensive- for-Millennials?utm_source=Mic Check&utm_campaign=2b200dd408-

Thursday_July_167_15_2015&utm_medium=email&utm_term=0_51f2320b33- 2b200dd408-285306781. - “Renting Less Affordable Than Ever Before, While Mortages Remain Affordable, by Historical Standards,” Zillow, August 13, 2015, http://zillow.mediaroom.com/ php?s=28775&item=137182.

- Kim-Mai Cutler, “A Long Game,” TechCrunch, January 27, 2016,http://techcrunch.com/2016/01/27/a-long-game/.

- Richey Piiparinen, Jim Russell, and Charlie Post, “The Fifth Migration,” The Cleveland Foundation,January 20, 2016, https://www.clevelandfoundation. org/2016/01/the-fifth-migration/

- Nick Timiraos, “New Housing Headwind Looms as Fewer Renters Can Afford to Own,” The Wall Street Journal, June 7, 2015, http://www.wsj.com/articles/new- housing-crisis-looms-as-fewer-renters-can-afford-to-own-1433698639?cb=logg 8265339631128316.

- William H. Frey, “Melting Pot Cities and Suburbs: Racial and Ethnic Change in Metro America in the 2000s,” Metropolitan Policy Program at Brookings, May 2011,http://www.brookings.edu/~/media/research/files/papers/2011/5/04%20 census%20ethnicity%20frey/0504_census_ethnicity_frey.pdf.

- Census Bureau Current Population Survey for 2013 to 2014. The number is actually higher, because this report uses the “principal cities” to identify non-suburban Principal cities include the core cities as well as municipalities that are suburban employment centers and which are overwhelmingly suburban in their built form. Wendell Cox, “Urban Cores, Core Cities and Principal Cities,” August 1, 2014, http://www.newgeography.com/ content/004453-urban-cores-core-cities-and-principal-cities.

- Joel Kotkin, “The Changing Geography of Asian America: To the South and the Suburbs,” New Geography, September 13, 2012, http://www.newgeography.com/content/003080-the-changing-geography-asian-america-to-the-south-and-the- suburbs.

- Joel Kotkin and Wendell Cox, “The Evolving Geography of Asian America: Suburbs are High-Tech Chinatowns”, New Geography, March 19, 2015, http://newgeography.com/content/004875-the-evolving-geography-asian-america- suburbs-are-new-high-tech-chinatowns; Jon C. Teaford, The American Suburb: The Basics (New York: Routledge, 2008), 82-83.

- Francis Wilkinson, “Why are Liberal Cities Bad for Blacks?” Bloomberg View, April 9, 2014.http://www.bloombergview.com/articles/2014-04-09/why-are-liberal- cities-bad-for-blacks.

- Aaron Renn, “The White City,” New Geography, October 18, 2009.http://www.newgeography.com/content/001110-the-white-city; Stu Kantor, “How Do the Top 100 Metro Areas Rank on Racial and Ethnic Equity?” Urban Institute, February 2, 2012,http://www.urban.org/publications/901478.html.

- Heather Knight, “Families’ exodus leaves S.F. whiter, less diverse,” SF Gate, June 10, 2013,http://www.sfgate.com/bayarea/article/Families-exodus-leaves-S-F-whiter-less-diverse-3393637.php; Nikole Hannah-Jones, “In Portland’s heart, 2010 Census shows diversity dwindling,” The Oregonian, May 6, 2011, http://www.oregonlive.com/pacific-northwest-news/index.ssf/2011/04/in_portlands_heart_diversity_dwindles.html; Dick Morrill, “Seattle is shedding diversity; the state’s minority populations grow,” Crosscut, April 29, 2011,http://crosscut.com/2011/04/29/seattle/20804/Seattle-is-shedding-diversity-states-minority-popu/

- Evelyn Wang, “Housing Solution: Increase Density in Western Neighborhoods and Fix Transit,”San Francisco Public Press, October 27, 2014, http://org/news/2014-10/housing-solution-increase-density-in-western- neighborhoods-and-fix-transit; Matthew Yglesias, “The Biggest Thing Blue States Are Screwing Up,” Real Clear Policy, August 29, 2014,http://www.realclearpolicy.com/2014/08/29/the_biggest_thing_blue_states_are_screwing_up_21791.html.

- Gerard Mildner, com/2014/08/29/the_biggest_thing_blue_states_ are_screwihttp://www.pdx.edu/realestate/sites/www.pdx.edu.realestate/files/Mildner_UGR_article_3.pdf.

- Jonathan Fearn, Denise Pinkston, Nicolas Arenson, “The Bay Area Housing Crisis: A Developers Perspective,” Submittal to Plan Bay

- Eric Jaffe, “Where Sprawl Makes It Tougher to Rise Up the Social Ranks,” CityLab, January 27, 2016, http://www.citylab.com/commute/2016/01/sprawl-social- mobility-ewing-chetty-krugman/431535/?utm_source=SFTwitter.

- David King, “Sprawl and Economic Mobility: A Comment,” Getting from here to there blog, July 29, 2013, http: blogspot.com/2013/07/sprawl-and- economic-mobility-comment.html.

- Affluence measured by gross metropolitan product per capita, adjusted for purchasing See:http://www.newgeography.com/content/004853-10-most- affluent-cities-world-macau-and-hartford-top-list and http://www.demographia. com/db-worldua.pdf

- Michael Lind, “Spreading the Wealth: Decentralization, Infrastructure and Shared Prosperity”, inAmerica’s Housing Crisis (Center for Opportunity Urbanism: Houston, 2016).

- Author’s analysis of EMSI 2.

- Joel Kotkin and and Michael Shires, “The Cities Stealing Jobs from Wall Street”, New Geography,June 27, 2014, http://www.newgeography.com/content/004390- the-cities-stealing-jobs-from-wall-street; Susan Fainstein, The City Builders: Property, Politics and Planning in London and New York (London: Blackwell Publishers, 1994),

- Aaron Renn, “The Rise of the Executive Headquarters,” New Geography, April 15, 2014,http://www.newgeography.com/content/004265-the-rise-executive- headquarters.

- Aaron Renn, “Chicago is Winning the Battle for the Executive Headquarters,”

Urbanophile, January 31, 2016, http://www.urbanophile.com/2016/01/31/

chicago-is-winning-the-battle-for-the-executive-headquarters/; Claire Bushey, “The Incredible Shrinking HQ,” Crain’s Chicago Business, February 1, 2016, http://www. chicagobusiness.com/section/hq. - Aaron Renn, “Why High Taxes Aren’t the Only Reason GE Left Connecticut,” New Geography,January 20, 2016, http://www.newgeography.com/content/005148-why-high-taxes-aren-t-only-reason-ge-left-connecticut.

- Bill Hethcock, “Here’s the main reason Toyota is moving from California to Texas,” Dallas Business Journal, December 14, 2015, http://www.bizjournals.com/dallas/blog/2015/12/heres-the-main-reason-toyota-is-moving-from. html?surround=etf&ana=e_article.

- Scott Donaldson, “City and Country: Marriage Proposals”, in New Towns and the Suburban Dream,Irving Lewis Allen (Port Washington, NY: Kennikat Press, 1977), 101.

- Calculated from American Community Survey, 2013, one year

- Calculated from Census Bureau County Business Pattern data at the Zip code (ZCTA)

- Derived the CoStar Office Report: National Office Market, Midyear 2012 and Midyear 2015,https://www.costar.com/.

- Wendell Cox, “Dispersion and Concentration in Metropolitan Employement,” New Geography, May 13, 2015, http://www.newgeography.com/content/004921- dispersion-and-concentration-metropolitan-employment.

- Wendell Cox, “Dispersion and Concentration in Metropolitan Employment,” New Geography, May 13, 2015, http://www.newgeography.com/content/004921- dispersion-and-concentration-metropolitan-employment.

- Dominic Basulto, “The future of innovation belongs to the mega-city”, com, October 28, 2014,http://www.dailynews724.com/local/the-future-of- innovation-belongs-to-the-mega-city-h287221.html.

- Author’s analysis of EMSI 2 employment data.

- Henry Grabar, “The Biggest Problem with San Francisco’s Rent Problems,” Slate, June 22, 2015,http://www.slate.com/articles/business/metropolis/2015/06/san_ html.

- Wendell Cox, “2010 Major Metropolitan Area & Principal Urban Area (Urbanized Area) Population & Density”, Demographia, http://demographia.com/db-pdf.

- Joel Kotkin and Mark Schill, “The Valley and the Upstarts: The Cities Creating the Most Tech Jobs”, New Geography, April 15, 2015, http://www.newgeography. com/content/004899-the-valley-and-the-upstarts-the-cities-creating-the-most- tech-jobs.

- ATL Urbanist, “Streetcar Tour of Bad Land Use in Atlanta”, Streetsblog Southeast, August 7, 2015,http://www.washingtonpost.com/wp-dyn/content/ article/2009/09/18/AR2009091801306.html; Eric Klinenberg, Going Solo: The Extraordinary Rise and Surprising Appeal of Living Alone (New York: Penguin, 2013),

- Christopher Kennedy, “Energy and material flows of megacities,” Proceedings of the National Academy of Sciences of the United States of America 112 (2015): 5985-5990http://www.pnas.org/content/112/19/5985.full.pdf.