TxDOT Highway Construction Inflation

This week we have another always-excellent analytical post from Oscar Slotboom.

In July I blogged about the cost of highway and transit construction in Houston, and I mentioned that highway construction costs were showing a sharp upward trend, consistent with infrastructure cost increases nationwide.

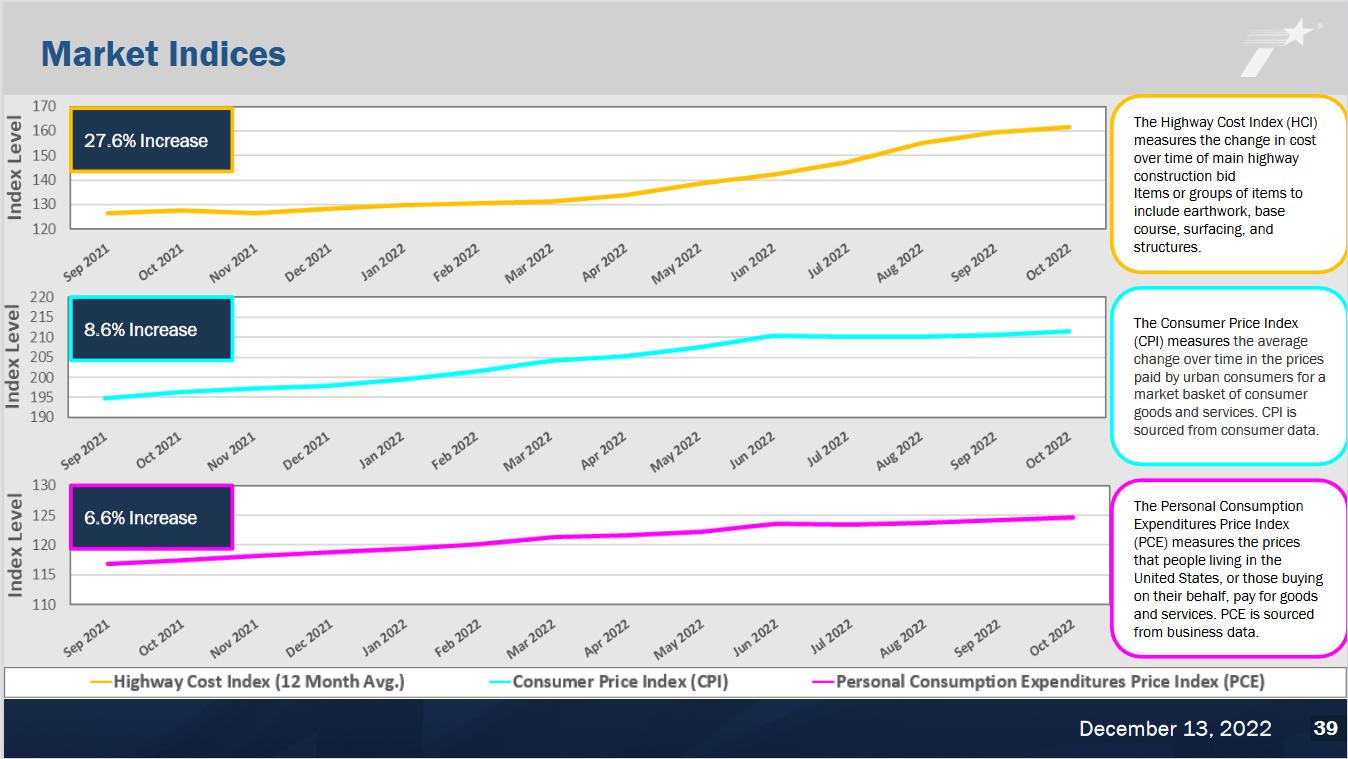

More data became available at the December TxDOT Commission meeting with a presentation on the subject of inflation. Video of the presentation and discussion is online, agenda item 6B. The screenshot below from the presentation shows that between September 2021 and October 2022 the Highway Cost Index (HCI) increased by 27.6%, with most of the increase occurring between March and October. During this period the consumer price index was up 8.6%.

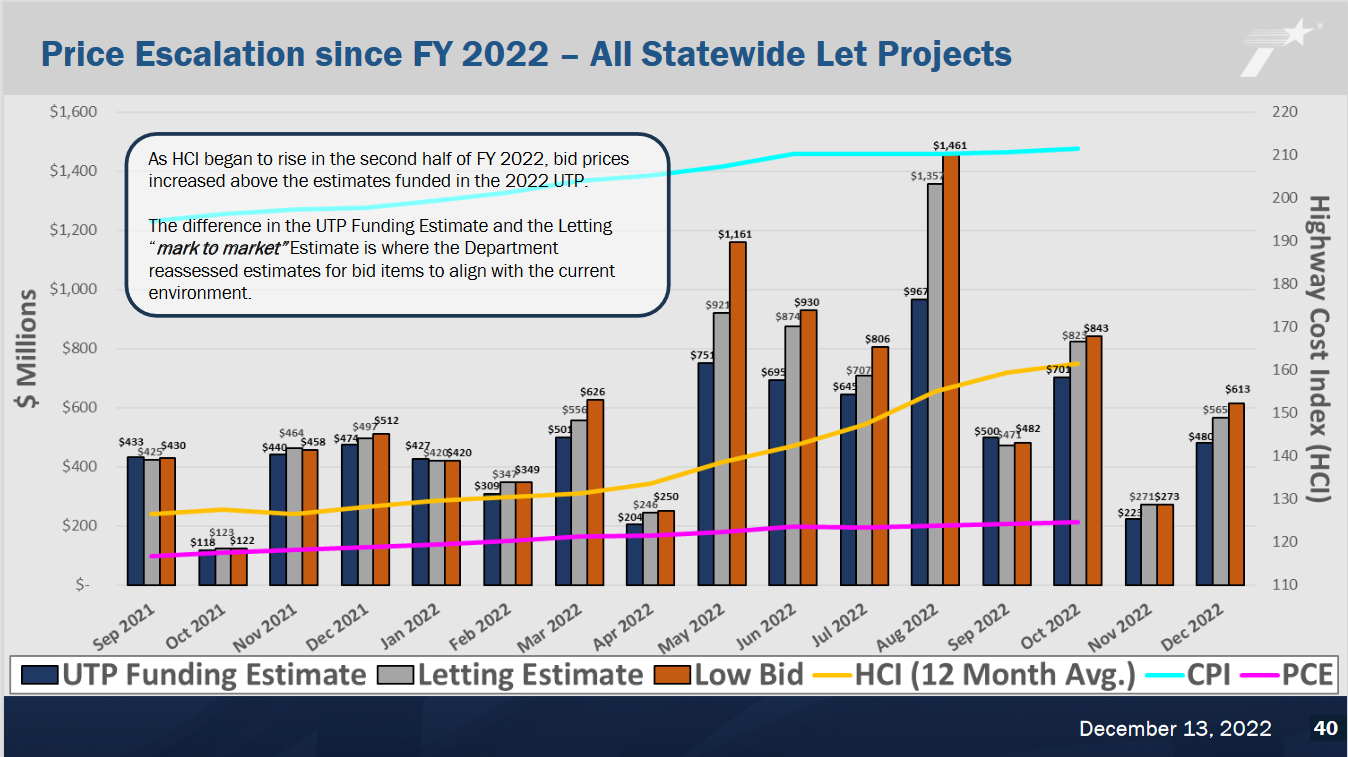

All projects receiving bids have an estimated cost in the TxDOT UTP, which schedules projects based on available funding. As reported at 1:29:30 in the video, bids for the period Sept 2021 to Dec 2022 exceeded the UTP estimate by $1.9 billion.

In recognition of the inflation, TxDOT raised the estimates of project cost above the UTP estimate. They call this “mark to market”. However, if you look at the following chart in the presentation, low bids (orange bar) are also exceeding the “mark to market” letting estimate (gray bar).

As discussed at 1:34:00, the revised project costs for the remaining eight bid lettings for fiscal year 2023 is $8.5 billion compared to $7 billion in the UTP, for an expected cost increase of $1.5 billion.

As noted at 1:30:20, bids are exceeding estimates the most on large projects which have long construction periods. It is believed that contractors are bidding high to protect themselves in case inflation remains high during the multi-year time-span of large projects. That’s a well-known problem with inflation. When it becomes established and embedded into people’s behavior and thinking, it becomes more difficult to bring the inflation rate back down.

No Houston projects have been affected so far, mainly because there have not been any large projects in metro Houston which received bids in the last 6 months. At the December meeting, TxDOT rejected a $510 million low bid on a large project on Interstate 30 northeast of Dallas which was 23% above the mark-to-market estimate of $414 million.

So far, TxDOT has been able to use reserve funds to cover the inflation for most projects, with the Dallas project the only major casualty. But reserve funds won’t last forever. Unless prices go down, there will be consequences, mainly projects being delayed or placed on indefinite hold as available funding can no longer cover the cost of planned projects. As for NHHIP, the soonest the first project (I-69 in Midtown) could go to bidding is June 2024, and the first very large job (over $1 billion), Interstate 10 on the north side of downtown, is currently listed for bidding in 2027. We can definitely expect cost estimates to be revised upward. In the short term the future of the project depends on a ruling from the Federal Highway Administration, and in the long term the project schedule could be adversely affected by cost increases.

The good news is that TxDOT officials are optimistic the inflation rate has peaked and is now in a downward trend. The HCI is a lagging indicator. As is visible in the first chart, it started to go up after the CPI started to go up. Now that the CPI has been flat for several months, the HCI should follow the same path within a few months. And if highway construction contractors can get confidence that their costs are under control, the all-important psychological influence may start to be more favorable for better bid pricing.

There’s no readily available data for public transit construction cost, but it’s virtually certain that costs are up by a similar amount for Metro’s priority projects, the Inner Katy BRT and the University Line BRT. I’m not aware any official updated cost data for Metro projects. Recent online reports (1, 2) have focused more attention on the absurdly high cost of building rail transit in the United States. Metro’s Red Line north extension appears to be years in the future, after the priority projects. When we get a new cost estimate for these three projects, we can expect a big increase.

This piece first appeared at Houston Strategies.

Tory Gattis is a Founding Senior Fellow with the Urban Reform Institute and co-authored the original study with noted urbanist Joel Kotkin and others, creating a city philosophy around upward social mobility for all citizens as an alternative to the popular smart growth, new urbanism, and creative class movements. He is also an editor of the Houston Strategies blog.

Photo: graphs courtesy Houston Strategies Blogspot.

Roy Luck

Roy Luck