Houston Asks Voters to Approve $478 Million in New Debt

Despite being awash with federal aid, $607 million since 2021, and benefiting from annual property tax increases, $27 million more this year, the City of Houston is asking voters this November to approve $478 million in local debt.

Mayor Sylvester Turner also said he plans to ask voters for an exemption to the city’s voter-imposed property tax during next year’s municipal elections.

In a 16-1 vote, Houston City Council approved the $478 million bond package with Council Member Mary Nan Huffman being the lone “no” vote.

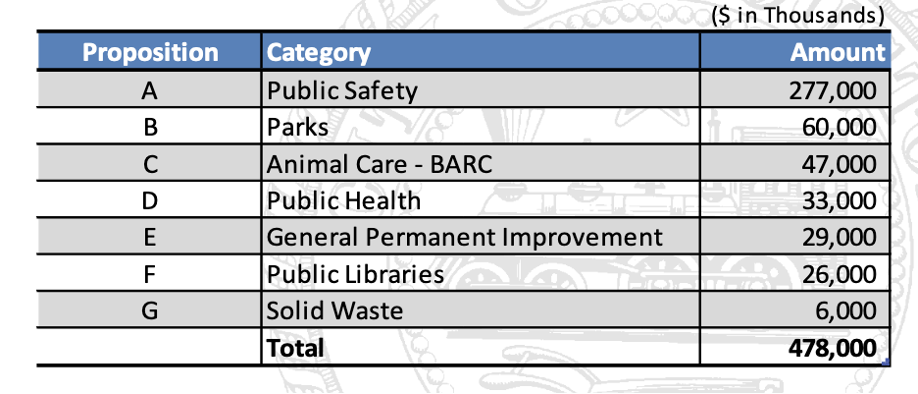

The proposal, vague on specifics, consists of seven broad categories of funding: Public safety, parks, animal care, public health, general improvement, libraries, and solid waste.

The lack of details means voters will cast votes without knowing things like whether “public safety” means funding for gun buyback programs or more Houston Police Department cadet classes, which parks will see upgrades, what projects fall under “general permanent improvements”.

Also, $274 million of the package is anticipated to be held until, at least, 2028 for projects yet to be announced, leaving even more questions than answers.

In the last two decades, Houston voters have authorized public improvement bonds in 2001, 2006, 2012, and 2017 totaling roughly $2.3 billion, according to the city’s annual financial report.

As of the end of fiscal year 2021, Texas local governments had $266.38 billion in outstanding local debt with cities accounting for 31.6% or just more than $84 billion. According to recent data, Texas ranks third among the 10 most populous states in terms of local debt per capita.

According to the city’s most recent annual financial report, Houston has $3.4 billion in outstanding general obligation debt, $1.8 billion is owed to public improvement bonds.

As debt accrues, debt payments crowd out other parts of the city’s already bloated budget which is, in part, why the mayor plans to ask voters for an exemption to the city’s property tax cap.

Voters approved the city’s property tax cap in 2004 through the charter amendment process. The cap limits the city’s year-to-year revenue growth by restricting it to the previous year’s cap plus population and inflation or the prior year’s revenue plus 4.5%, whichever is lower.

2015 was the first year the city hit the cap but since then the has been forced to reduce the tax rate, saving taxpayers $1.5 billion. This year alone it is saving taxpayers $322.7 million. Turner says he plans to bring to council a proposal that will lift the cap for a temporary exemption to provide additional funding to police and fire.

As voters consider adding more debt to an already mounting debt load for a city that has received a record amount of federal funding, and benefits from increased property and sales tax revenue each year, they must also question the city’s prioritization of public services. Local government always finds funding to grow programs of their choosing but places the burden on taxpayers to provide additional funding for what should be core services.

Houston should show fiscal restraint rather than repeatedly looking to taxpayers to dig the city out of avoidable financial holes.

Charles Blain is the President of Urban Reform institute, a think tank that focuses on free market solutions to urban issues and creating opportunity for all in America’s metropolitan areas. Charles has been published in the Wall Street Journal, Forbes, the Houston Chronicle, the Hill, Wired, and other publications. He is a Fox 26 Houston (KRIV) regular political commentator and weekly panelist on Sunday talk show, What’s Your Point. He is also a regular guest speaking about local issues on I Heart Radio’s Pursuit of Happiness, The Michael Berry Show, and Houston’s Morning News w/ Jimmy Barrett & Shara Fryer.

Trackbacks & Pingbacks

[…] is also planning to ask voters next year to lift the city’s property tax cap, which limits its year-to-year revenue growth to the previous year’s cap plus population and […]

Comments are closed.